Solutions Enabling

"Insurance-in-a-box"

Bringing deep domain expertise and technology that enables enterprise efficiency via a smart consulting service.

Growing Economic Uncertainties Have Been a Leading Cause For Increased Risk Faced By Insurance Carriers

However, policyholders’ expectations to have a seamless and personalized omni-channel experience, growing regulatory compliance requirements, keeping up with technology advancements is an important and urgent initiative for insurers to act upon amidst these uncertainties.

To tackle these challenges efficiently and enhance business growth, Insurance Carriers need a technology partner who comprehends these specific challenges faced by insurance industry.

Smart IMS recognizes the need to rethink customer engagement models, digitize distribution and operations, and embrace data analytics to stay competitive. Our unique solution offering, “Insurance-in-a-Box,” focuses on adopting a comprehensive approach to restructuring insurers’ operating models.

To know more, schedule a consultation, download our brochure, or experience the future of insurance with a “Insurance-in-a-Box” demo.

Unique Challenges Faced by the Insurance Industry:

Customer and Agent Engagements

Increase in Insurance Options

Carriers find themselves competing with not just traditional competitors and distribution channels but also new and Tech-Empowered players that are disrupting the way insurance is sold and serviced.

Easy Access to Insurance Services

Digital savvy customers and distribution partners expect round the clock, omni-channel self-service ways that are engaging and easy to use when purchasing insurance products.

Neglected Agent and Auxiliary Systems

As compared to investments made to modernizing internal ecosystems, too little is spent on upgrading technology tools that enable agents and other distribution channels to do their job efficiently and effectively.

Ever-Changing Customer Preferences

These include factors such as age, language, wage, lifestyle, work-culture, and expectations that are rapidly changing with both current and new customers.

Insurance Operations

Product Lifecycle

The speed with which carriers are required to develop, market, distribute, and manage, insurance products is getting shorter than ever as they try to retain existing customers and acquire new ones while the cost of doing so escalates

Lower Investment Income

Reduced investment income means carriers have a greater need to make an underwriting profit and manage underwriting expenses effectively

Increasing Expenses

Increase in Replacement costs, raw material, cost of parts, transportation, labor etc. have led to adverse pressures on profitability for carriers

Rising Inflation

Inflation has a direct impact on a carriers cost and ability to settle claims speedily which in turn impacts the overall profitability.

Infrastructure and Domain Expertise

Talent Attraction and Retention

Carriers find themselves at a disadvantage in terms of their ability to attract, retain and replace talented individuals with specialized skills and knowledge of the industry and this impacts their ability to address and tackle many of the other challenges.

Technology Debt and Backlogs

Carriers struggle to keep up with technological infrastructure improvements and have an ever-growing backlog of projects to execute and to remain competitive in the market.

Cost Effective Data Management

Carriers are obliged to turn to data and analytics to detect potential exposures early and devise mitigation plans accordingly, but this comes at a cost and a burden to smoothly integrate with data providers and vendors.

Business Assurance

Increased usage and frequent changes in the technology infrastructure leads to increased need to manage these changes and to invest in quality insurance programs to avoid disruption of service to customers and partners.

Prevailing Market Conditions

Changes in Risk Exposure

Changes in the frequency and severity of claims, new exposures with the passage of time, environmental, and political factors have a huge impact in terms of the profitability and performance hindering the carriers ability to underwrite new business.

Disruptions in Supply Chain

Global economic, political, and climate changes has an impact in terms of cost and time for carriers to settle claims thereby impacting the profitability of their business

Regulatory Compliance

Carriers find themselves with an Increased regulatory and compliance burden impacting their ability to focus on business retention and growth

Economy

Through analytics driven solutions and predictive modelling, carriers must be prepared for changes in demand for insurance coverage caused by economic cycles that affect the customers’ need for and ability to purchase insurance products and services.

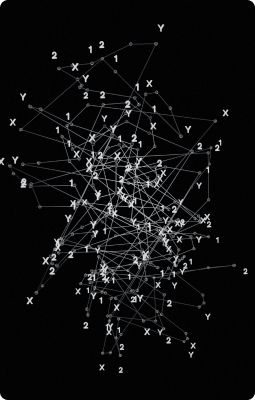

End to End Insurance IT Solutions

The main components of the IT infrastructure is vital to the functioning of Insurance businesses.

Infrastructure

Includes systems aiding in embedding business intelligence - analytics, reporting and historical repositories, etc.,

Platforms

Includes portals that are available to the customer to explore and purchase new insurance products and manage them.

Includes external systems with specialized and customized offerings such as digital marketing platform, websites, etc.,

Includes systems that are used for information exchange between key insurance stakeholders, helping in conversations, reporting, notifying etc.

Interfaces that the agents use to fulfil their core functions - onboard new customers, manage their own KPIs

Systems

Includes the heart of Insurance Processes like Policy Administration, Underwriting Workbench, Rating Engine, Claims System, Reinsurance Management, Billing, Ledger and Financial Management

Includes platforms with auxiliary functions such as CRM, Document Management, Workflow/BPM, etc.,

Innovate Customer Engagement Models, Digitized Operations and Analytical Data Distribution

Technology performance, over the years, has become one of the critical areas of focus for business success.

However, one of the biggest challenges holding insurers back from innovation is capacity—physical capital, human capital and executive mindshare.

By reallocating necessary resources from core business tasks to potential disruptive initiatives, insurers can scale from short-term incremental gains to potential breakthroughs in technological advancements, market reach and efficient business models.

Smart IMS understands the complexities that this shift from the traditional way of conducting business brings. Smart IMS’s “Insurance-in-a-box” solution reimagines the operational models of insurers to ensure business relevance and continuity into the future. The core objective of this solution is to:

- Upgrade legacy operations for better enterprise efficiency.

- Increase resilience to uncertainties of the future.

- Lower TCO

- Unbind IT bandwidth for strategic initiatives.

An End-to-End Enterprise Insurance Solution

Discover our comprehensive suite of cutting-edge solutions tailored to help you thrive in a dynamic industry landscape.

Our Insurtech Service

Insurance Cloud

Application Monitoring

Quality Assurance

SE CUR

E

Implementation Services

SOL UTI ONS

Application Management Services

Infrastructure Mangement

Alliances That Foster Advancement

Why Smart IMS?

Strong foundations that help Smart IMS deliver excellence.

Industry Expertise

Our team has over two decades of experience and a thorough understanding of P&C insurance, allowing us to deliver innovative and compliant solutions while staying up to date with industry trends and regulations.

End-to-End Management

Our comprehensive business consulting services guide you through every step of the process, from initial assessments and strategy development to implementation and ongoing support, ensuring a seamless and successful transformation.

Regulatory Compliance

Remaining compliant with industry regulations is non-negotiable. Our consultants are knowledgeable in insurance industry regulations, ensuring that your business remains in full compliance throughout your journey.

Customized Solutions

Our innovation labs focus on building insurtech solutions and are tailored to your unique challenges, opportunities, and goals, providing solutions aligned with your vision and strategy. Our services aim to improve risk analysis, pricing, efficiencies in claims management, and automation in business operations.

Technology Integration

Our team has expertise in both business strategy and technology, allowing us to guide you through selecting, implementing, and integrating cutting-edge insurance software and systems for optimal efficiency and effectiveness.

Cost Efficiency

Smart IMS boasts of a robust delivery framework built on the principles of faster, better, and cost-effective solutions. With the help of a brilliant team of experts, we craft processes and technology solutions to deliver our services effectively.

Meet Our Industry Leaders

Practice Leader – Insurance

Shyam Vellala comes with 25 years of experience in providing transformation, innovation, and delivery of high-quality business solutions to P&C Insurance customers in US and APAC geographies. He has previously held roles in business consulting, solution strategy, client management and delivery leadership. As the Business Unit head for our Insurance practice at Smart IMS, he is responsible for scaling up the practice and providing superior experience to our clients.

Shyam comes with successful track record in solving complex business problems and making high-stakes decisions using experience-backed judgment, strong work ethics and integrity. He has led several large transformational initiatives using global delivery models and set up CoE for industry-best Insurance products such as Guidewire, Duck Creek, One Shield and Majesco. Shyam enjoys working closely with key decision makers and excels in achieving operational excellence.

As a person, Shyam is a firm believer in expression of care and concern, motivates people to work towards a common worthwhile goal, a certified coach who is passionate about unlocking people’s potential and a philanthropist by heart. He is part of several community outreach programs.

Managing Director – Insurance

Anil has been at the forefront of the (P&C) insurance industry, with over 3 decades of mentoring, monitoring, and leading teams throughout his career. His expertise and commitment to advancing technology has led him to join Smart IMS Inc. as a Strategic Advisor and mentor.

Anil has a strong history of creating, delivering, and monetizing software assets and processing platforms for the North American P&C insurance industry. He was also one of the key players in the founding of STG, an NYC-based startup that provided product-based solutions for the US P&C insurance industry, which was later acquired by Majesco in 2008. As the chief architect for STG suite of Insurance products, Anil pioneered efforts for the insurance industry’s first solution in a hosted Application Services Provider model.

Anil’s experience and insight have been instrumental in helping to shape the North American P&C insurance industry. He is an invaluable asset to Smart IMS Inc. and our mission to bring technological advancements to the P&C industry.

Technology Leader – Insurance

Vinod brings over three decades of IT experience, specializing in leveraging technology to drive growth and enhance capabilities within the Property and Casualty (P&C) insurance sector. His expertise lies in aligning technology initiatives with strategic business goals, facilitating digital transformation, and developing tailored solutions that improve efficiency, reduce costs, and enhance customer satisfaction.

An active contributor to the open-source community, Vinod has extensive knowledge of multiple programming languages and frameworks. He is currently focused on exploring the potential of Generative AI to push the boundaries of innovation. Passionate about mentoring, Vinod enjoys guiding aspiring tech professionals as they navigate their career paths.

Get in Touch

Connect with us to learn more on how to optimize your business through our transformational enterprise solutions and services.